What is Stader? Building Infrastructure For Staking | Basics of Staking | BNBx Explained and Possibilities

By developing essential staking middleware infrastructure for Proof-of-Stake networks, Stader offers smart contract architecture for staking, assisting users to stake their assets through its platform quickly and safely.

|

| Staderlabs |

Building an economic ecosystem to expand and create solutions like yield redirection with rewards, liquid staking, launchpads, gaming, and more, Stader is developing native smart contracts across various chains, including Terra, Solana, Ethereum, Fantom, Hedera, and Polygon. Third parties can use the components of Stader's modular smart contracts to create bespoke solutions.

What is Stader?

For token holders to simply and safely stake their assets across validators on Proof-of-Stake (PoS) networks, Stader is developing essential middleware technology.

The top validators in PoS networks now own a significant amount of the stake and voting power. Their existing staking infrastructure is also not designed for decentralization. Mid-to-long tail validators have significant validator turnover because they find it difficult to draw delegations.

On the other side, token users are less informed of staking-related indicators and must go through a laborious validator finding and delegation procedure. Additionally, they must manually track and handle staked assets, awards, and airdrops following delegation.

By making it simple for delegators to stake with a basket of validators, Stader addresses these problems. Stake Pools categorize validators based on important factors including uptime, slashing history, community involvement, etc. With the click of a button, delegators can stake to the pool of their choice, and Stader controls the delegation of stakes to validators algorithmically.

Stader distinguish ourselves from existing staking protocols with modular approach to developing smart contracts. Stader design gives us the freedom to expand and constantly add new features as demand changes. Stader's technical vision incorporates extensibility through a system of highly interactive smart contracts.

Stader uses several contracts to divide the principle capital and the benefits. This makes sure that interactions with other protocols never affect the major capital staked.

On the user side, Stake Pools categorize validators according to important factors like uptime, slashing history, community involvement, etc. With the click of a button, Delegators can stake to the pool of their choice, and Stader controls the delegation of stakes to validators algorithmically. Stake Pools product's primary attributes include some of the following:

- To reduce cutting risks and promote network decentralization, many validator pools are available to delegators.

- Higher returns due to auto-compounding of awards (converting stablecoins to LUNA and restaking).

- One-click airdrops providing substantially cheaper transaction costs for Stader stakers

Stader is developing an economic ecosystem to grow and develop solutions like YFI-style farming with awards, launchpads, gaming with prizes liquid staking solutions, and more. Stader is extending its native staking smart contracts from Terra to various chains including Solana and EVM chains.

Get involved with Stader community

Discord

Telegram

Medium

Basics of Staking:

What is Liquid Staking?

It is important to understand that the cryptocurrency staking market is dominated by liquid staking technologies. It has transformed the DeFi industry's ability to access liquidity.

The ability to utilize your money to invest in other projects while collecting rewards or returns is one of the key advantages of liquid staking. As a result, it serves as a strong foundation for activities like lending processes and yield farming. Users may now connect with several DeFi platforms and get a variety of benefits from a single pool of cryptocurrency funds.

The main opportunities for Liquid Staking are:

🔹 Liquidity mining

🔹 Farming rewards for liquidity providers

🔹Staking rewards on farmed tokens

🔹 Yield aggregators & vaults

🔹Borrowing & Lending

Why do we need Liquid Staking?

Liquid staking is also referred to as “soft staking.” As known above, it is a process of locking up your crypto funds to earn rewards while still having access to the funds you staked. It is a profitable way to put your idle crypto assets to work and earn a passive income.

Suppose your crypto is “locked” in the staking process, then you cannot do any of these — transfer, sell or use it in any way you want until a defined staking period ends. These periods depend on the coin you are staking and your chosen platform. Typically, the timeline for the staking period is somewhere from days to weeks or even months.

How does Liquid Staking work?

You mint liquid tokens when you stake your tokens in liquid staking.

Your staked assets are represented by these liquid tokens.

That means: With these liquid tokens, you can explore other #DeFi options while your original tokens are staked and locked.

For instance:

These liquid tokens can be used as collateral for other assets loans.

Depositing these lent assets will earn you respectable returns.

Short version: With liquid tokens, you may add new yield streams to the existing ones that were staked while still reaping the benefits.

These liquid tokens have yet another application.

They serve as your staked assets, so you may exchange or sell them to obtain immediate liquidity.

Meaning: Using a liquid token is the best approach to increase your liquidity without having to wait for the unstaking time.

The ownership of your staked assets is transferred when you transfer the liquid tokens.

It's that easy.

Plain Staking vs Liquid Staking:

Plain staking is when you stake your tokens for a certain period of time for an ROI.

This means you're locking away your crypto, leaving no options to use them in the meantime.

That sucks right?

Also, If you want to unstake your assets, you have to wait for the unstaking period to end.

It could be a few days or even a few weeks.

And while you wait, if the value of your asset depreciates, you lose money.

There's no way around it.

But with liquid staking, this is not the case.

You can receive liquid tokens with a comparable value in exchange for your staked cryptocurrency by using liquid staking.

As staking incentives continue to accrue, the value of this liquid token increases over time relative to the underlying currency.

This liquid token may be redeemed, traded, transferred, exchanged, or invested in DeFi protocols.

In essence:

Instant liquidity is unlocked through liquid staking, which also enables many passive revenue streams in addition to staked payouts.

Regarding staking, the benefit is great.

You may decide whether to use liquid or plain staking.

Benefits of Liquid Staking:

1. Yield Farming

Yield farming is the primary cornerstone of liquid staking. It occurs when a trader locks money in a certain protocol and receives a tokenized or wrapped version of that money.

The trader would then use another liquid staking protocol to stake the tokenized money, receiving a tokenized version of the funds staked in return. The trader can decide whether or not to use another liquid staking technique with the tokenized money. As a result, by locking up several assets at once, you may yield on several assets.

2. Crypto backed loans

Owning cryptocurrencies can occasionally result in the need for immediate access to more fiat money. However, most investors are hesitant to liquidate their holdings.

What is a fantastic replacement for them in this situation? Yes, they utilize their current cryptocurrency holdings and the liquid staking system to obtain a loan secured by cryptocurrency. Investors may quickly convert their assets into fiat money with the use of tokenized representations of their holdings.

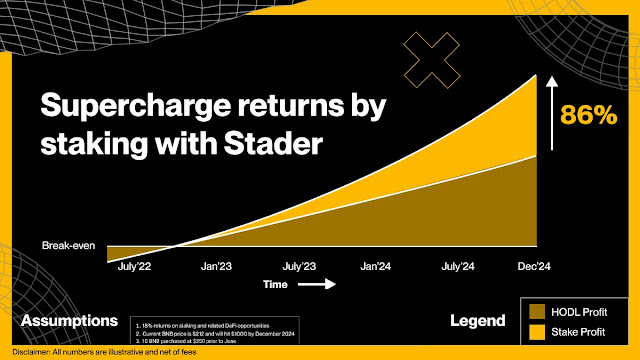

How Staking helps in a BEAR MARKET?

If you are in for the long run

It's time to earn some extra returns from your $BNB.

All you need to do is Stake it with Stader.

When you stake your BNB with Stader rather than just holding it,

You can end up with up to 86% return on your BNB holding by 2023/24

All thanks to $BNBx, a reward bearing liquid token minted upon staking $BNB with Stader

BNBx Explained: (#BNBxplained)

What does #BNB stand for?

It stands for “Build 'N Build”

Hence, no coincidence that most crypto projects are built on it.

Also, BNB is;

✨ User-friendly blockchain ecosystem

✨ Takes low gas fee & has a huge user base

✨ 1Bn+ growth funding

But what's next for BNB?

BNB wants to create the foundation for a parallel virtual environment throughout the globe!

By use of the idea of MetaFi (Metaverse + DeFi)

Imagine a meta ecosystem with a broad spectrum of blockchain functionalities.

Not only that, but there will soon be more improvements made to it!

BNB envisions a multi-chain interoperability

To meet more demand for decentralized computing power & storage

Hence, Stader is so pumped up about BNB!

Now, you will ask how does BNBx work?

By Staking with Stader & minting BNBx

Here is how BNBx increases in value through staking

How does BNBx generate yield?

Step 1:

At the start when TVL = 0, BNBx: BNB exchange rate is set as 1

User stakes 100 $BNB

User receives an equivalent 100 $BNBX

Stader distributes the staked 100 $BNB among validators

Over time, staking rewards worth 10 $BNB are generated and added to the stake pool

The 100 $BNBx now represents 110 $BNB.

Thus the BNBX: BNB exchange rate is 1.1

Step 2:

The user stakes another 100 $BNB

In return, the user gets 90.9 $BNBX

Remember the exch rate is 1.1

Now, the total staked TVL is 210 $BNB and this gets distributed among validators

Over time, staking rewards worth 22 BNB are added.

Now the 190.9 $BNBx in circulation represents 232 $BNB giving us an exchange rate of ~1.22

Step 3:

The user now unstakes 50 $BNBX

50 $BNBx is burned, so the remaining BNBx is 140.9

The user gets back 60.8 $BNB

Prevailing Latest Exchange rate: 1.22

Total $BNB left in the contract is 171.2 and $BNBX is 140.9

What’s next for Liquid Staking in the future?

For the majority of cryptocurrency enthusiasts who want to stake by issuing tokens, liquid staking addresses the issue. As a result, the blockchain ecosystem is now more secure, reliable, and simple to manage. Stakeholders will then be able to develop into a useful and creative method for blockchains to reach consensus.

Furthermore, it is prudent to state that Liquid Staking supports the fundamental principles of DeFi by providing people with the tools they need to make smarter financial decisions.

BNBx-Rewards Explained:

Before we get into the operation of BNBx and the details of the reward structure, let's take a quick look at a few crucial words.

Stake Pool TVL (Total Value Locked): The amount of BNB in the Stader staking smart contract is known as Stake Pool TVL (or simply TVL). This consists of all BNB staked with Stader, as well as all awards earned thus far, less any withdrawals made through unstaking.

The annualized rate of rewards that are contributed to the Stake Pool TVL every epoch is known as the APY.

Note that APY is dynamic and is dependent on the returns provided by different validators on the network, not a fixed rate of return for the whole year.

The BNBx: BNB exchange rate will be initialized as 1 at the start of the contract.

Every time staking rewards are added to the pool, the BNBx<>BNB exchange rate will increase using this formula:

New BNBx<>BNB Exchange Rate = Current BNBx<>BNB Exchange Rate + (Rewards Added/Total BNBx in circulation)

Thus, BNBx is a reward-bearing liquid token i.e. the value of 1 BNBx token vs. BNB increases over time as staking rewards accumulate.

What fees can one expect to incur when staking BNB with Stader?

An estimated list of the different costs that will be associated with BNB staking operations is shown below.

Transaction Cost: The Binance network levies a transaction fee for different transactions made using the Stader smart contract. Stader neither sets the charge rate nor does it get any of the money collected.

10% of the awards added to the pool will be charged by Stader as a protocol fee. You only pay commission on rewards obtained through staking, never on staked BNB (the staker only earns money when you gain!).

Autocompounding with BNBx:

The eighth wonder of the world is compounding.

And if you don't use it, you might be losing out on up to 20% in staking returns.

Astounding, huh?

What's even better, though?

Compounding automatically!

The way Stader's Auto-compounding boosts your returns is as follows.

Generally, when you stake your BNB for rewards, you have to actively receive those rewards & put them back into staking.

This process is continuous & time-consuming.

And you lose out on a lot because of missed cycles, delayed activity, & other factors.

However, the Auto-compounding function of Stader handles the work for you.

Staking rewards are automatically invested back into the validators' accounts.

Users benefit from much higher returns from their BNB because to this innovation.

So how does it work?

When you stake through Stader, you receive $BNBx against your total staked amount.

Assume that when you invest, 1 $BNBx = 1 $BNB

With 7% APY and no compounding, you would have 1.07 $BNB in a year

But, With Stader’s auto-compounding after year 1,

1 $BNBX = 1.073 $BNB (7.3% return)

BNBx Security features:

When customers entrust you with their money, security is a key consideration.

Stader uses a multi-level security system to maximize security and protect the cash.

The security aspects of Stader are shown below.

Integrated security measures:

We have employed multi-sig administration to make sure that no single individual has access to the keys necessary to modify the contract.

Additionally, we use best-in-class cloud security capabilities for our staking solution, protecting any components housed off-chain.

A number of independent smart contract audits:

It's impossible to be too cautious.

Because of this, two of the most reputable companies in this field, Halborn and Peckshield, have audited our code.

Additionally, we are always comparing our criteria to those of other noteworthy initiatives.

Partnership between BNB Chain:

We work closely with the BNB chain team, who have repeatedly tested our code and provided us with comments on the design.

Getting advice from the top students in the class is usually beneficial.

Ongoing monitoring:

We are engaging with various security firms that specialize in ongoing monitoring and threat detection, to ensure security on an ongoing basis.

This extends to every aspect of our product including blockchain connections, staking, & selecting validators.

BNBx Possibilities:

|

As of date, 81% of all BNB tokens are staked.

The higher the number of tokens staked, the more secure the network is.

However, because the staked amount gets locked, you can't leverage DeFi opportunities on the staked BNB to increase your yields.

When you stake your $BNB through Stader, you mint BNBx, a reward-bearing liquid token, to deploy in DeFi opportunities.

This way, you get staking rewards and additional yield by deploying the liquid token across DeFi protocols.

That is the magic of $BNBx!

To get the most out of $BNBx in terms of staking incentives and DeFi income, you may use a variety of tactics.

Here are some tips for you:

Low Risk-Low Return

Use $BNBx to borrow Stablecoins.

Then stake them in the ecosystem to earn more rewards.

At the same time, your collateral $BNBx earns more rewards as well.

This will maintain a healthy cash flow to your wallet.

Mid Risk-Mid Return

Use $BNBx and go heavy on $BNBx - $BNB LP.

Even if you're low on the degen scale, this is a balanced tactic.

$BNB <> $BNBx exchange rate will likely stay very stable…

So, the risk of impermanent loss is very low.

High Risk - High Reward

Bullish on $BNB? This one is for you.

1 - Borrow any BEP-20 token (preferably stablecoin) from a lending/borrowing protocol against $BNBx

2 - Swap the borrowed asset for more $BNB

3 - Stake these $BNB on Stader to mint more $BNBx

Repeat.

5 Yielding Strategies for BNBx:

The BNBCHAIN is a gold mine of DeFi opportunities.

Thanks to $BNBx you'll be able to:

Earn juicy staking rewards + Grab tasty yield opportunities

$BNBX is a liquid token that you can mint by staking your $BNB.

That means: Your $BNB helps secure the BNB CHAIN network and fetch you amazing rewards.

Plus: You go on to grab other lucrative DeFi opportunities with $BNBx.

Here are 5 exciting strategies to do that:

Strategy 1: Converts $BNBx to stables and invests them

Simply borrow stables or any other coins against $BNBx and put them to use in DeFi strategies.

Plus, your $BNBx collateral earns you staking rewards.

Two birds. One stone.

Strategy 2: Gets $BNBx to go heavy on $BNBx - $BNB LP

Not a Degen?

Yet you're bullish on $BNB?

This is your best option.

Since $BNB and $BNBx stay very close to 1:1 ratio...

There's almost ZERO impermanent loss.

Safe yet rewarding.

Strategy 3: $BNBx - $BNB (AGGRESSIVE MODE)

In addition to earning LP rewards in Strategy 2...

You can leverage fam your LP rewards and 3-5x your rewards.

Again, you don't suffer impermanent loss by providing to $BNBx - $BNB pool for reasons mentioned in Strategy 2.

Strategy 4: Creates loops & leverage by borrowing and staking more

Feeling extra bullish on $BNB?

We've got just the 3-step degen leveraged lending strategy for you.

Step 1 - Borrow any BEP-20 token (preferably stablecoin) from a lending/borrowing protocol against $BNBx

Step 2 - Swap the borrowed asset for more $BNB

Step 3 - Stake these $BNB on Stader to mint more $BNBx

How many times can you repeat this strategy?

That relies on the lending/borrowing protocol's collateralization ratio.

The number of times you can loop the method depends on your collateralization ratio.

Even with a broad ratio, you'll probably loop it long enough to double your earnings by three to four.

Strategy 5: Stablecoins LPs for the rainy days

Feel bearish and want to shield your funds from an unfortunate downside?

Simply provide in a $BNBx - Stablecoin pool.

This allows you to hedge against a downside. While continuing to earn LP and staking rewards.

DeFi Opportunities:

To enable users to take advantage of a variety of yield possibilities, BNBx may be utilized with Stader partner DeFi protocols, such as DEXs, money markets, and yield aggregators.

MINT BNBx: binance.staderlabs.com

|

| binance.staderlabs.com |

FOLLOW - Stader.BNB on Twitter.

Comments

Post a Comment